Proxy Capital

How it Works & How We Do It

Proxy’s team of fiduciary investment advisors employ over 78 years of combined private debt and equity investment experience. Whether the objective is to hedge or diversify ones investment strategy or seek to properly approach investments with a potentially higher risk and return matrix, Proxy has the process driven approach and long standing relationships to confidently unlock an all new asset class of investments.

Proxy Capital Partners provides access to premium Private & Alternative Asset investments. With regorous vetting, deal structuring and active management, we aim to create value and grow wealth for our partners and investors alike.

- Private Debt & Equity Services Private investment can unlock incredible and unique potential, but requires many specific expertise’s to successfully execute. To help, Proxy offers: deal consulting services for investors, deal architecture services for General Partners and monitoring & administration, broker dealer, client relationship management, and marketing & compliance oversight for back offices. Wherever you stand in a deal, Proxy can be there to ensure excellence in execution and fiduciary responsibility every time.

- Broker Deal Services Proxy has customized its platform so as to partner with Broker Dealers based on their industry specialty. Whether your goal is to sell new products, source capital or holistically manage a public fund offering, Proxy has the right licenses (Series 7, 6, 63, 66 and 24) and partnerships in place to keep your business on point.

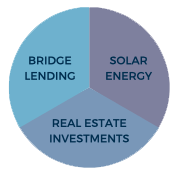

- Real Estate Funds & ESG Investments Proxy has spent nearly half a decade creating relationships with some of the best minds in the alternative real estate and ESG investment space. With this experience, and over a decade in the industry with over USD 3 billion in private transactions, we believe there is a lack of both access and transparency into these investments. This makes it difficult for many investors to participate. This barrier, coupled with the increasing utility of such investments, has led Proxy to create our ALTERNATIVE INVESTMENT MENU, a short list of cultivated programs that we believe investors should be looking to when seeking non traditional investment strategies.

- EB5 Administration Services Since its inception, Proxy has been deeply embedded in the Eb5 ecosystem both through the protection of investors and the support of the project creators. Through our Proprietary Fund Administration Services, advanced deal architecture support and ongoing investor relation systems, Proxy has the unique services that your project needs to thrive in the new landscape.

Questions to ask when considering Alternative Investments